Thinking of buying property in 2025?

Smart move — and even smarter if you choose the right city. 📍

Whether you’re after strong rental yields, capital growth, or a dream home, this list has you covered.

Here’s your ultimate guide to the 15 best cities to buy property in the UK this year — and why they’re on top. 🚀

1. Manchester

Why:

- Northern Powerhouse investment continues.

- Massive student and young professional population.

- Rental yields up to 7% in some areas.

Hot Spots: Salford Quays, Ancoats.

2. Birmingham

Why:

- HS2 rail project will slash travel time to London.

- Big city, lower prices compared to London.

- Booming tech and finance sector.

Hot Spots: Digbeth, Jewellery Quarter.

3. Liverpool

Why:

- Regeneration around the Baltic Triangle and waterfront.

- Affordable prices + high yields (up to 8%).

- Huge cultural scene attracts young tenants.

Hot Spots: Ropewalks, Wavertree.

4. Leeds

Why:

- Growing economy, thriving student scene.

- New developments like SOYO district.

- Excellent rental demand.

Hot Spots: Headingley, Holbeck.

5. Bristol

Why:

- Strongest economy outside London.

- High salaries, high rental demand.

- Beautiful historic areas mixed with modern developments.

Hot Spots: Bedminster, Bishopston.

6. Nottingham

Why:

- Two major universities (Nottingham and Trent).

- Affordable homes compared to nearby cities.

- Rental yields around 6-7%.

Hot Spots: West Bridgford, The Park.

7. Sheffield

Why:

- Massive investment in city centre regeneration.

- Affordable and rising property values.

- Fast-growing young workforce.

Hot Spots: Kelham Island, Ecclesall Road.

8. Glasgow

Why:

- Strong rental yields (~7%).

- Huge student population.

- Prices still much lower than Edinburgh.

Hot Spots: West End, Dennistoun.

9. Edinburgh

Why:

- Steady price growth.

- Strong tourist and corporate rental market.

- Beautiful, historic architecture boosts value.

Hot Spots: Leith, Newington.

10. Cardiff

Why:

- Capital city advantages with smaller price tag.

- Rapid population growth expected by 2030.

- Major waterfront regeneration.

Hot Spots: Cardiff Bay, Roath.

11. Newcastle

Why:

- Excellent universities.

- Great rental demand and value properties.

- HS2 Northern connections to boost in future years.

Hot Spots: Jesmond, Ouseburn.

12. Milton Keynes

Why:

- Commuter heaven: 30 minutes to London.

- New city status awarded in 2022 = investment boom.

- Lots of new build opportunities.

Hot Spots: Brooklands, Broughton.

13. York

Why:

- Beautiful historic city — always in demand.

- Tourism boosts short-let market.

- Limited space for new builds = rising prices.

Hot Spots: Clifton, South Bank.

14. Reading

Why:

- Big tech employers (Microsoft, Oracle, Huawei).

- Crossrail opened (Elizabeth Line) = super-fast London access.

- Very strong rental market.

Hot Spots: Caversham, Central Reading.

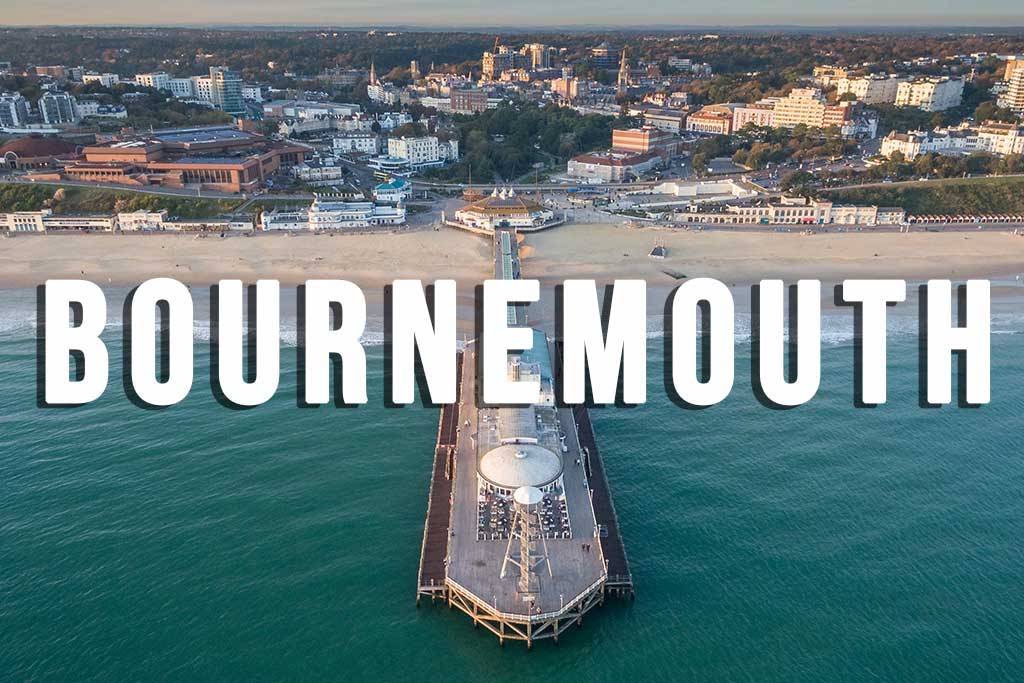

15. Bournemouth

Why:

- Coastal living + city life balance.

- Huge remote working population post-2020.

- Property prices growing steadily but still accessible.

Hot Spots: Boscombe, Westbourne.

📈 Key Trends for Property Buyers in 2025

- North still winning: Manchester, Liverpool, Leeds remain investment hotspots.

- Commute cities booming: Milton Keynes, Reading, and others linked to London growing fast.

- Coastal growth: More buyers want seaside living (Bournemouth, Cardiff Bay).

Tip:

Buy in cities with regeneration projects — they often boost prices by 20–40% over 5–10 years.

🚀 Ready to Start Your Property Journey?

Buying in the right city can make a MASSIVE difference to your future wealth.

🏡 Browse the latest listings now at LiveRentBuy.com — and find your next big move today! 🎯

Leave a Reply