When it comes to having your own space in the UK, you’re faced with two common options: renting or shared ownership. Both come with their pros, cons, and money matters you really need to understand before making a decision.

Whether you’re a first-time buyer or someone sick of paying a landlord’s mortgage, this guide will break down what you need to know — in plain English — to help you decide what’s actually smarter for your situation.

🔍 What is Shared Ownership?

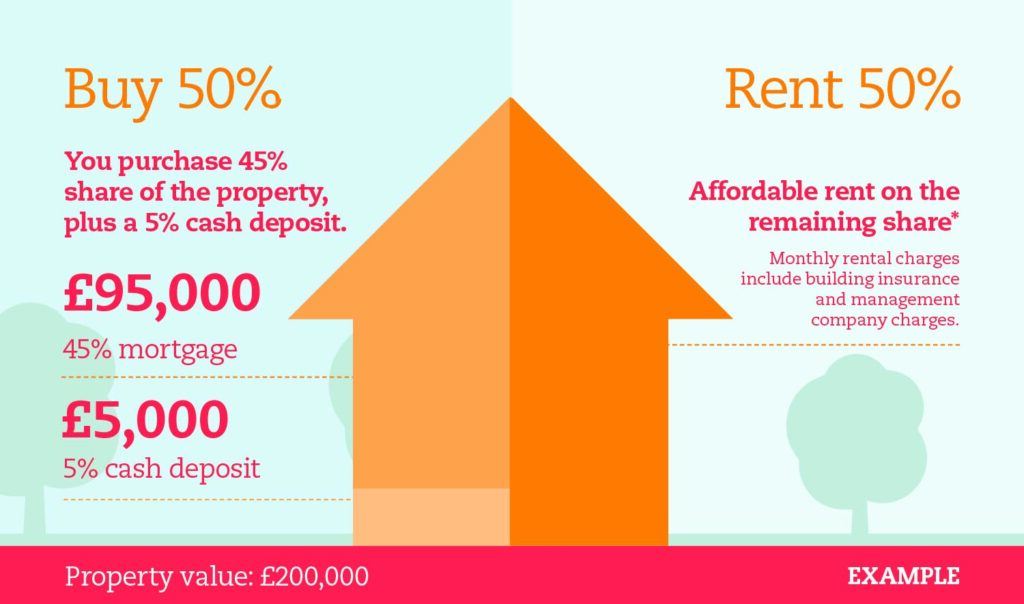

Shared ownership is a government-backed scheme where you buy a share of a property (typically 25–75%) and pay rent on the rest to a housing association. Over time, you can buy more shares in a process called “staircasing”, and eventually own the whole thing if you want.

✅ Pros of Shared Ownership:

- Lower deposit (usually 5–10% of the share you’re buying, not the full property value)

- You’re on the property ladder

- You can staircase to full ownership gradually

- You often get access to new build homes

- It’s ideal for first-time buyers with limited savings

❌ Cons of Shared Ownership:

- You still pay rent on the part you don’t own

- Staircasing can be expensive (legal fees, valuations)

- Selling your share can be more complicated

- Service charges and maintenance costs can be high

- Not available everywhere — mostly in urban or regeneration areas

🔍 What is Renting?

Renting is exactly what it sounds like — you pay a monthly fee to live in a home you don’t own. It’s flexible, fast, and comes with less responsibility.

✅ Pros of Renting:

- No big deposit (usually 1–2 months’ rent upfront)

- No responsibility for repairs or maintenance

- Easier to move out or relocate

- Less paperwork and lower upfront costs

❌ Cons of Renting:

- You’re paying someone else’s mortgage

- No long-term asset growth

- Rent prices can increase unexpectedly

- Landlords can choose not to renew your lease

- You’re often restricted (no pets, no painting walls, etc.)

💸 Financial Comparison: Shared Ownership vs. Renting

Let’s break this down with some realistic numbers.

🏠 Example: Shared Ownership

- Property full value: £250,000

- You buy a 40% share = £100,000

- 10% deposit = £10,000

- Mortgage on £90,000 (roughly £450/month)

- Rent on remaining 60% = ~£375/month

- Service charge & fees = £150/month

- Total monthly cost = ~£975

🛏 Example: Renting Similar Property

- Monthly rent = £1,100–£1,200

- Deposit = £1,200 (1 month)

- No mortgage or ownership

- No service charge (usually)

⚖ Summary:

- Shared ownership is usually cheaper monthly and gives you equity.

- But requires more upfront savings and comes with extra responsibilities.

🧮 Mortgage Calculator (Rough Guide)

Use tools like:

- MoneyHelper Shared Ownership Calculator

- Habito Mortgage Calculator

- Shared Ownership Hub Affordability Checker

These can give you real-time estimates based on:

- Your income

- Your deposit

- Desired property value

- Current interest rates

🤔 Who Should Consider Shared Ownership?

Choose shared ownership if:

- You have some savings but not enough for a full deposit

- You’re ready to settle down for 3+ years

- You’re in a high-rent area where buying outright isn’t realistic

- You want to build equity over time

🤔 Who Should Stick to Renting?

Stick to renting if:

- You need flexibility (e.g. moving jobs, travelling, not ready to settle)

- You can’t afford mortgage repayments + rent + service charges

- You’re new to the city and want to get a feel before committing

- You don’t want the hassle of ownership responsibilities

📍 Location Matters

Shared ownership schemes are more common in:

- London

- Manchester

- Birmingham

- Leeds

- Regeneration towns like Luton, Croydon, Milton Keynes

Renting might be better in:

- Smaller towns with cheaper rents

- Short-term living situations (internships, uni years, contract work)

🧾 Shared Ownership Schemes to Explore in 2025:

- SO Resi

- Home Reach

- Shared Ownership by Peabody

- London Home Ownership Scheme

- First Homes Scheme (discounted full ownership — great alternative)

✅ Final Verdict: What Makes More Financial Sense?

| Factor | Shared Ownership | Renting |

|---|---|---|

| Monthly Cost | ✅ Usually Lower | ❌ Often Higher |

| Deposit Needed | ❌ £5–15k+ | ✅ 1–2 months’ rent |

| Flexibility | ❌ Long-term commitment | ✅ Easy to move |

| Equity/Asset Growth | ✅ Yes | ❌ None |

| Upfront Costs | ❌ Higher | ✅ Lower |

| Long-Term Security | ✅ Yes | ❌ Limited |

| Overall Simplicity | ❌ More complex | ✅ Easier process |

If you’re ready to put down roots, shared ownership can be a smart stepping stone onto the property ladder — but only if you’re financially ready for the extra fees and long-term commitment.

If your life is still full of change — job moves, location shifts, or financial instability — renting is the safer bet.

📲 Want to Find Shared Ownership Properties or Rental Homes?

Check out listings and expert guides on LiveRentBuy.com. We cover:

- First-time buyer guides

- Property search filters for shared ownership

- Verified rental homes across the UK

- Advice on deposits, moving, and getting approved

Leave a Reply