Thinking about renting your first home? It’s exciting — but it can be confusing too.

Follow these 10 smart tips to rent wisely, avoid costly mistakes, and make the most of your budget.

1. Start Your Search Early

Good rentals disappear fast. Aim to start looking at least 3–4 months before you need to move.

2. Know Your Budget

Rent should ideally not be more than 30–35% of your monthly income.

(Example: If you earn £2,000/month, aim for £600–£700 rent.)

3. Save for Upfront Costs

Besides rent, you’ll need money for:

- Deposit (usually 5 weeks’ rent)

- First month’s rent upfront

- Moving costs (van hire, setup fees)

4. Understand the Tenancy Agreement

Don’t sign blindly! Check details like:

- How long you’re tied in

- Notice period

- What counts as “damage” vs “wear and tear”

5. Research the Area

Visit in person if possible.

Test commute times, walk around at night, check local amenities.

6. View More Than One Property

Even if you love the first one, compare others. You’ll have better bargaining power and find hidden gems.

7. Ask About Bills

Clarify what’s included and what isn’t:

Electricity, water, broadband, council tax, TV license.

8. Use Protected Deposit Schemes

Legally, your deposit must be placed in a government-backed scheme like DPS, MyDeposits, or TDS.

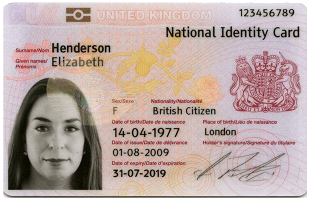

9. Be Ready With Paperwork

Speed matters when applying. Prepare:

- Proof of income

- ID documents

- Previous landlord references

- Guarantor info (if needed)

10. Inspect Everything Carefully

Before moving in, create a full inventory list and take pictures of any damage — protect yourself from unfair charges later.

🎯 Final Thoughts:

Renting smart doesn’t mean rushing — it means planning.

With these tips, you’ll avoid nasty surprises and find a home you truly enjoy.

LiveRentBuy.com makes it easier to rent your first home the smart way!

Leave a Reply